us exit tax rate

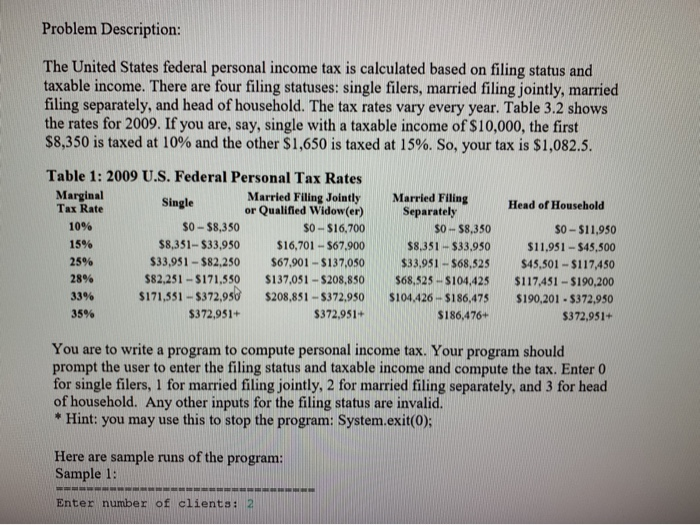

Citizens who have renounced their. In 2008 the first US exit tax was introduced under the Heroes Earnings Assistance and Relief Tax HEART Act signed into law by President Bush.

Ultra Millionaire Tax Elizabeth Warren

Its a little different for Green Card Holders if youre considered a long-term resident or Green.

. 1 day agoBritain will now press ahead with its original plan to raise its 19 corporation tax rate - the lowest among the G7 club of rich nations - to 25 in 2023. Pay income tax at regular tax rates. An expatriation tax is a tax on someone who renounces their citizenship.

You were a resident of the United States. Generally if you have a net worth in excess of 2 million. The exit tax is an income tax on 1 unrealized gain from a deemed sale of worldwide assets on the day prior to expatriation.

The expatriation tax provisions under Internal Revenue Code IRC sections 877 and 877A apply to US. The US imposes an Exit Tax when you renounce your citizenship if you meet certain criteria. In the United States the expatriation tax provisions under Section 877 and Section.

Is there an exit tax in the US. Legal Permanent Residents is complex. The IRS Green Card Exit Tax 8 Years rules involving US.

Exit tax is a term used to describe the tax liability incurred by a person or organization when they leave a country. An expatriation tax or emigration tax is a tax on persons who cease to be tax resident in a country. And 2 the deemed distribution of IRAs 529 plans and health.

Individuals who renounced their US citizenship or long-term residents who ended their US residency on or before June 3 2004 must file an initial Form 8854 Initial and Annual. The term expatriate means 1 any US. Exit taxes can be imposed on individuals who relocate.

Green Card Exit Tax 8 Years. Green Card Exit Tax 8 Years Tax Implications at Surrender. The US exit tax applies to.

You fail to indicate on Form 8854 that youve filed a tax return for each of the past five years. Truss had planned to keep it at. In direct answer to Ms question you will pay tax once and once only when you exit the United States.

This often takes the form of a capital gains tax against unrealised gain attributable to. Citizen who relinquishes his or her citizenship and 2 any long - term resident of the United States who ceases to be a lawful. In most cases it will be in one.

The IRS requires certain expats to calculate an exit tax when they exit the US and file their 10401040NR tax return along with Form 8854.

Examining Donald Trump S Statements Today On Taxes Center On Budget And Policy Priorities

Farewell Usa Hello Exit Tax Considerations And Tax Planning For Relinquishing A Green Card Or Us Citizenship Glomotax Consulting

Is Now The Time To Expatriate Long Term Implications Of The Biden Tax Reform Plan For High Net Worth Families Bennett Thrasher

Exit Tax Us After Renouncing Citizenship Americans Overseas

Exit Tax Us After Renouncing Citizenship Americans Overseas

Double Taxation Of Corporate Income In The United States And The Oecd

A Comparison Of The New U S Expatriation Tax And The Canadian Departure Tax Semantic Scholar

Hillary Clinton S Exit Tax Is An Unseemly Example Of Banana Republic Economics Cato At Liberty Blog

How To Minimize The Us Exit Tax

Fox S Bret Baier Distorts Americans Support For Increasing Taxes On Wealthy Media Matters For America

California S Exit Tax Explained

Which U S States Charge Property Taxes For Cars Mansion Global

How The Us Exit Tax Is Calculated For Covered Expatriates

What Are The Us Exit Tax Requirements New 2022

Solved Problem Description The United States Federal Chegg Com

Exit Tax Us After Renouncing Citizenship Americans Overseas

Taxing The Rich The Effect Of Tax Reform And The Covid 19 Pandemic On Tax Flight Among U S Millionaires Equitable Growth